Blog : Big Opportunities From Obstacles

by Peter Leeds on July 6th, 2015

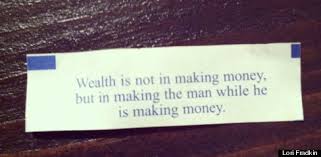

Fortunes are made during chaos, not from the good times. The timing to set yourself up is right now, since the summer weather has the majority of people distracted.

Several excellent opportunities exist right now, BECAUSE of issues globally, and here at home. Our analysis team is all over them.

For example, Puerto Rico is broke, as is Illinois, San Bernardino (California), Stockton (California), Detroit, Rhode Island, Jefferson County (Alabama), Central Falls (Rhode Island), Connecticut, and many others... This list is growing fast, but most Americans still aren't aware of any of it.

As these cities, municipalities, and States' financial woes start hitting the headlines, many will sell shares in reactionary panics. Since the summertime trading volume in stocks is low, even small orders to liquidate a position can cause a technical dip to highly undervalued prices.

Today, as one example, the overall markets were spooked (we'll explain why in a moment), driving down almost everything in sympathy. Shares like GM, which were already highly undervalued, slipped nearly 2%. I personally bought a position in General Motors, which was already due for an increase, and at current levels is paying a 4.4% dividend.

The reason the stock markets freaked out today was due to what we've been telling you, from as far back as a couple years ago. Glad to see everybody is finally catching up!

On Sunday, the people of Greece held a referendum, where 61% of them voted "no" to more austerity measures (in exchange for money from the International Monetary Fund (IMF), who could more accurately be called 'Germany').

The funds from the IMF would then be used to pay back debt owed to the IMF. In case you think you are mistaken, read that sentence again. A fifth-grader could tell you this is insane.

Anyway, let's get to the Spoiler Alerts:

- For now, the markets overreacted, and a deal will be made between Greece and the IMF (probably within a couple days).

- Greece stays in the Eurozone, and keeps the Euro, rather than reverting back to the Drachma.

- Greece is deeper in debt to the IMF (who, as we said, we'll call 'Germany').

- The Greek people face partial austerity measures, and some will see their pensions raided.

- Greek banks will come back online slowly, after recent capital restrictions and controls (reminiscent of Cyprus)

- A sense of normalcy will emerge.

- The stock markets get to have a day and a half relief rally, and then should hold up pretty well...

... at least until the world notices what's going on in China (again, more on that in a minute).

We told you about the problems in Greece years ago, and also recently as more people started taking notice of events we had already explained. Now we're telling you that some similar financial concerns are going to start springing up around you, in America.

By the time your neighbours and co-workers know about the domestic concerns, you will be too late. However, if you position yourself now, you will benefit as they catch up with reactionary panic buying.

Undervalued shares in high quality companies, with sub-30 Relative Strength Index (RSI) values, will weather the storm. When the markets slip, it is typically the shares which hold their price which become the big winners when the economy recovers. Just like our stock pick from Tuesday.

Now China... this is a bigger issue than ISIS, Iran, and Russia combined. China's stock market is fading fast after their dot-com-bubble-style run up until this point, right as their economy is slowing down markedly. China is still growing faster than most developed nations, but their GDP is rising at an alarmingly slow rate compared to recent decades.

This will result in diminished demand for the "commodities of production" (base metals, aluminium, steel, plastics...), but is creating massive opportunities in reaction.

Our analysis team is avoiding investments in areas potentially affected by a Chinese economic and investment slowdown. We are, however, looking through high-quality, undervalued companies with very low RSI indicators, growing market share, solid financial positions, and trading for very low prices.

We are moving those with Intellectual Property protections and disruptive technologies to the top of our list. Our next pick comes out Tomorrow.

As of January 2017 we no longer publish the blog and it has been removed from the webiste menu.

You are reading this old blog entry because we still like to reference it. :-)

You are reading this old blog entry because we still like to reference it. :-)

Get Our Best Low-Priced Investments

- don't have the time?

- can't do all the work required?

- want selections from the authority?

For only $199 per year, we give you our best high-quality, low-priced stock picks. Along with a full team, Peter Leeds is the widely recognized authority on small stocks. Start making money from penny stocks right away.