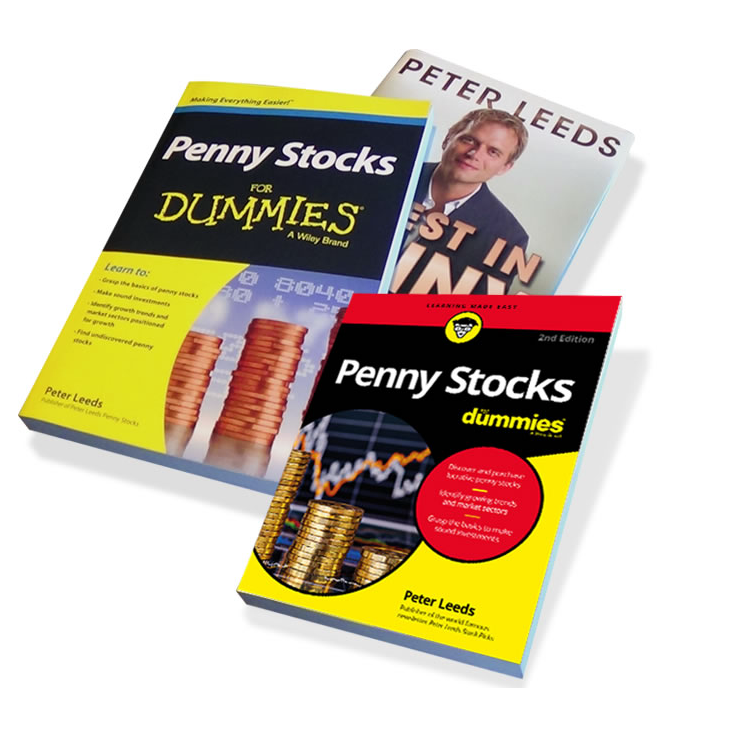

Peter Leeds, The Small Stock Specialist

- Books about Speculative Stocks

- Videos (Stocks, Economy, Gold/Oil, Real Estate...)

- Interviews by top media

You can get started right away! Get our best high-quality, low-priced

stock selections we believe will make you money

High-Quality, Low-Priced Stocks

- don't have the time?

- can't do all the work required?

- want selections from the authority?

For only $199 per year,

we give you our best high-quality, low-priced stock picks.

Along with a full team, Peter Leeds is the widely-recognized authority on speculative stocks.

Start making money right away.